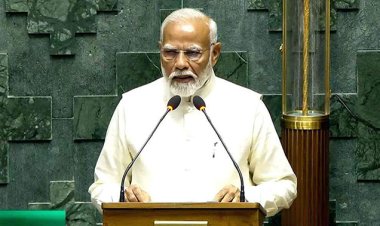

No tax for income upto Rs 7 lakh in new tax regime

Income Tax slab 2023-2024 live updates: New income tax regime has seen a major revamp in the income tax slab rates for 2023-24. The basic exemption limit under the new income tax regime has been hiked to Rs 3 lakh.

New Delhi: Income Tax slab 2023-2024: New income tax regime has seen a major revamp in the income tax slab rates for 2023-24. The basic exemption limit under the new income tax regime has been hiked to Rs 3 lakh. The income tax rebate limit available for salaried and individual taxpayers under the new income tax regime has been hiked to Rs 7 lakh from the present Rs 5 lakh. See the table below to know the income tax slabs 2023 for the new income tax regime.

Income Tax Slabs 2023: Tax slabs & rates for New

Income Tax Regime

> Up to Rs 3 lakh income there is 0% or NIL tax

> From Rs 3 lakh to Rs 6 lakh the tax rate is 5%

> From Rs 6 lakh to Rs 9 lakh the tax rate is 10%

From Rs 9 lakh to Rs 12 lakh the tax rate is 15%

> From Rs 12 lakh to Rs 15 lakh the tax rate is 20%

> Above Rs 15 lakh the tax rate is 30%

New Income Tax regime: These were the income

rates for 2022-23

Up to Rs 2.5 lakh income there is 0% or NIL tax

> From Rs 2.5 lakh to Rs 5 lakh the tax rate is 5%

> From Rs 5 lakh to Rs 7.5 lakh the tax rate is 10%

> From Rs 7.5 lakh to Rs 10 lakh the tax rate is 15%

> From Rs 10 lakh to Rs 12.5 lakh the tax rate is 20%

> From 12.5 lakh to Rs 15 lakh the tax rate is 25%

> Above Rs 15 lakh the tax rate is 30%

Highlights of major announcements

FM Nirmala Sitharaman has announced several new changes aimed at lowering the income tax burden and income tax outgo of the middle-class, salaried taxpayers, individual taxpayers and senior citizens. Below are the highlights of her major income tax announcements:

> New income tax regime will now be the default regime but taxpayers have an option to choose old regime

> Standard deduction of Rs 50,000 to salaried individual, and deduction from family pension up to Rs 15,000, is currently allowed only under the old regime. It is proposed to allow these two deductions under the new regime also.

> Rebate limit under the new tax regime to be increased from Rs 5 lakhs to Rs 7 lakhs. This means no income tax outgo for a taxpayer earning up to Rs 7 lakh and opting for the new income tax regime.

> An individual with an income of 15 lakhs will only be required to pay 1.5 lakhs as tax

>45% of filed returns processed within 24 hours, says FM

> Average Processing time of returns reduced from 93 days to 16 days, says FM

>Focus on technology based tax governance

Presumptive taxation turnover limit increased to 75 lakh for professionals. Cash receipt no more than 5%

>Roll out a next Gen-IT return form

> A system of unified filing process to be set up to facilitate agencies to source the data from a common portal as per the choice of those filing returns

> Exemption limit for leave encashment increased to Rs 25 lakh

> Surcharge on income-tax under both old regime and new regime is 10 per cent if income is above Rs 50 lakh and up to Rs 1 crore, 15 per cent if income is above Rs 1 crore and up to Rs 2 crore, 25 per cent if income is above Rs 2 crore and up to Rs 5 crore, and 37 per cent if income is above Rs 5 crore. It is proposed that the for those individuals, HUF, AOP (other than co-operative), BOI and AJP under the new regime, surcharge would be same except that the surcharge rate of 37 per cent will not apply. Highest surcharge shall be 25 per cent for income above Rs 2 crore. This would reduce the maximum rate from about 42.7 per cent to about 39 per cent. No change in surcharge is proposed for those who opt to be under the old regime.

>Encashment of earned leave up to 10 months of average salary, at the time of retirement in case of an employee (other than an employee of the Central Government or State Government), is exempt under sub-clause (ii) of clause (10AA) of section 10 of the Income-tax Act ("the Act") to the extent notified. The maximum amount which can be exempted is Rs 3 lakh at present. It is proposed to issue notification to extend this limit to Rs 25 lakh.